Over the past 18 months, the three biggest SVOD players in the UK – Netflix, Disney+ and Amazon Prime – have all launched new, advertising-enabled subscription packages.

This represents a major shift in focus for the streaming platforms, as they must now compete for ad spend as well as audiences.

With all three launching advertising propositions so close together, they’ll be competing with each other as well as a wide array of more established advertisers.

So how can Netflix, Disney and Amazon demonstrate the value of their audiences and differentiate themselves in this crowded market?

Heavy visitation

One way the streamers can do this is by using the heavy visitation segments in Ipsos iris. In iris, heavy visitors are defined as the top 20% of users for time spent on an online category.

These segments can help the streaming platforms to understand the proportion of their audiences that are heavy visitors to different online categories – like retail or finance – and show their value to advertisers in these sectors.

Netflix and Disney

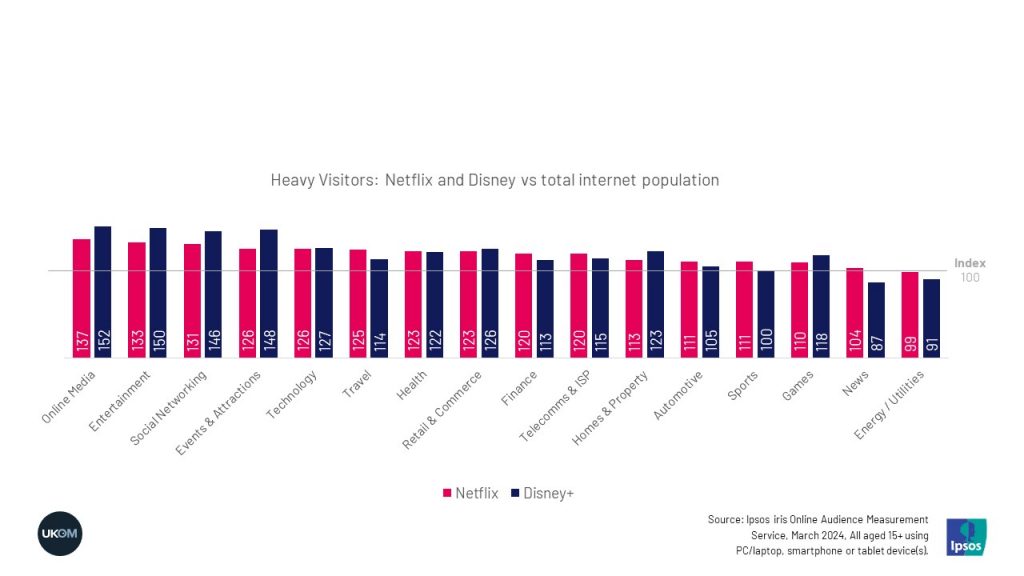

For this blog, we’ve looked at the proportion of heavy visitors on the two biggest SVOD platforms by audience size – Netflix and Disney – compared to the total internet population.

Whilst we cannot see data for connected TVs in iris, the rich data we have across smartphones, tablets, PCs and laptops, still highlights some key differences between the two streaming platforms.

One insight that quickly jumps out is that both platforms perform strongly across most categories when compared to the total internet population. Both will provide advertisers with an audience that is heavily engaged across a wide range of sectors.

However, when we compare the two, we see that Disney+ users are more likely to be heavy visitors of media categories like Online Media, Entertainment and Social Networking.

They are also more likely to be heavy visitors to the Homes & Property and Games categories. This makes Disney+ a great medium to reach the people who spend the most time on these categories online.

Digging deeper

Netflix users, on the other hand, are more likely to be heavy visitors of Travel, Finance, and Telecomms compared to Disney+ users. While this alone provides useful insight, it can also guide us on where to drill down deeper into the data.

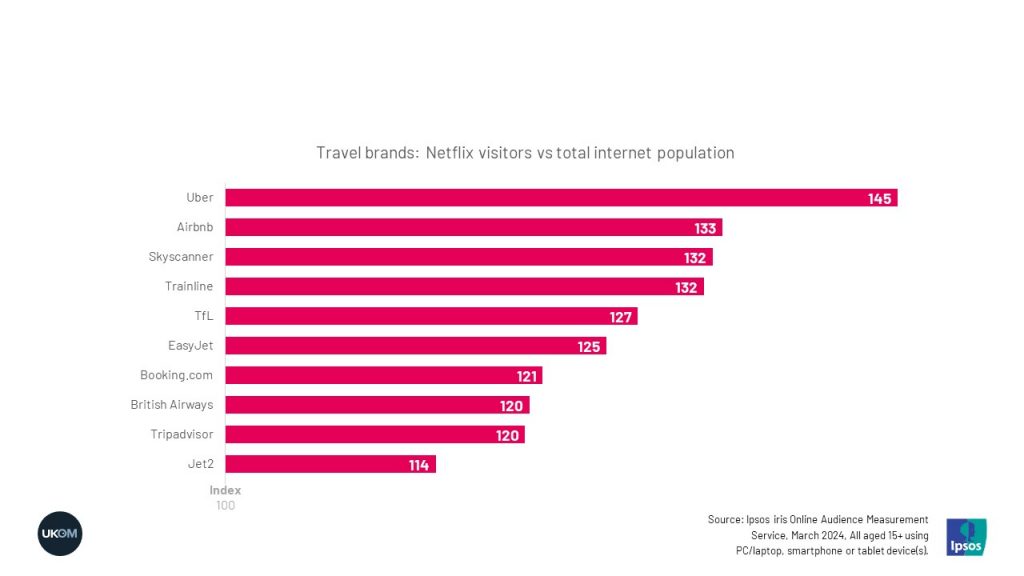

So, knowing that Netflix has a higher than average proportion of heavy travel visitors, we’ve looked at a cross-visiting report to see Netflix users’ affinity with the top 10 travel brands below.

Based on our heavy visitation segments, it is little surprise to see that Netflix users over-index for all 10 of the top travel brands, when compared to the total internet population. People who have visited Netflix on a smartphone, tablet, PC, or laptop are particularly likely to have also visited Uber in March (+45%) providing a strong foundation for a partnership.