Welcome to the September 2021 Digital Market Overview. This is the first report since Ipsos iris became UKOM’s approved solution for internet audience measurement data. The DMO provides a top-line snapshot of the UK population’s online behaviour across PCs, tablets and smartphones.

Whilst the DMO focuses on monthly aggregated data, Ipsos iris also produce daily data which is released 36 hours after day end and monthly data can now be analysed by daypart, day and week. The new solution also reports on 297 content categories and offers a wide range of profiling options beyond standard demographics including media usage and lifestyle statements. More information on the new methodology can be found here.

Key insights include:

- Nine out of the top 20 online organisations are British. The BBC leads the GB pack with a reach of 77% of internet users and a monthly audience of 39 million.

- Global giants Alphabet, Facebook (now Meta) and Amazon have the highest reach – all being used by over 90% of the UK online population.

- Half of the top organisations for ‘minutes’ do not feature in the top 10 for ‘audience’ including Bytedance (owner of TikTok) and Snap. Despite smaller audiences, their entrance into the top 10 is fuelled by very high average time per person of over 10 hours/mth. Whilst social media dominates the top 10 smartphone apps for time, the top 10 tablet apps feature video services including Netflix, BBC iPlayer, and Amazon Prime.

- The new daypart share of minutes analysis provides greater insight on what activities people are doing when. For example, gaming has a greater than average share in the evening and late night whereas business, finance and utilities have a higher share during daytime.

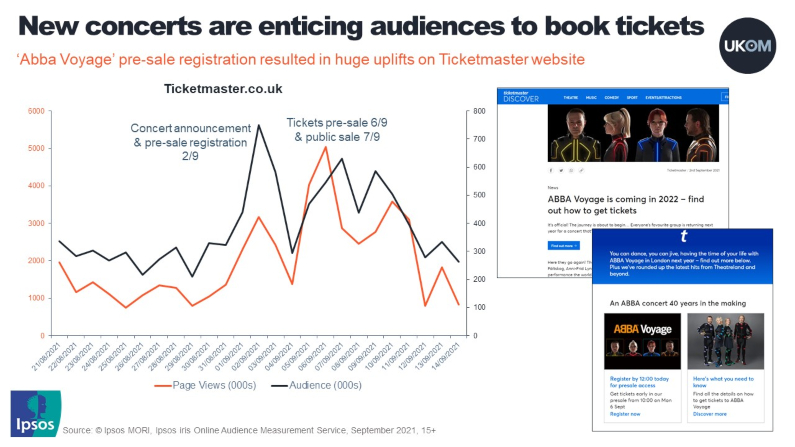

- Fastest growing categories in the last three months include events/attractions, travel and automotive. Of the retail sub-categories, ‘ticketing’ has increased its audience most since July adding almost 2.5 million between July and September. These category uplifts suggest people are booking tickets to live events with new movie and concert releases fuelling demand.

- New daily analysis provides more detail on the impact of new events on specific websites with huge peaks visible for Ticketmaster on the days of the Abba Voyage and Ed Sheeran tour announcements and booking days.

- Finally, the new top-line daily data can quickly provide insight into consumer behaviour around ad hoc occasions. For example, whilst an outage resulted in time online decreases for Facebook brands on the 04 October, it appears to have had a positive impact on usage of other brands. Twitter, Google messages, Yahoo mail and Netflix all witnessed significant uplifts in minutes on that day.

If you would like to know more about Ipsos iris, contact us at: support@ipsosiris.com