Mobile Gaming is having a moment

It’s attracting significant investment from the likes of Microsoft, who purchased Activision Blizzard for $69 billion in 2023, and Sega who acquired Rovio, the developer of Angry Birds, in 2022.

It’s also driving diversification: whether that’s news publishers like the New York Times following up on the success of Wordle with a whole suite of games, or streaming giant Netflix stating its intention to become a destination for ‘must play games’.

And it’s also empowering partnerships, with this year seeing Erling Haaland become the first real-life person to be featured in Clash of Clans, while Meghan Trainor launched the music video for ‘Made You Look’ exclusively on Candy Crush for the first 24 hours in 2022.

All three trends highlight how publishers, media owners, agencies and brands are waking up to the full potential of the mobile gaming audience.

But in such a busy media landscape and with other shiny, new platforms like CTV, retail media, and digital out-of-home also vying for investment, why should brands continue to invest in mobile gaming?

Well, when we looked at data from Ipsos iris* alongside data from Ipsos’ flagship gaming study, GameTrack**, five key reasons emerged:

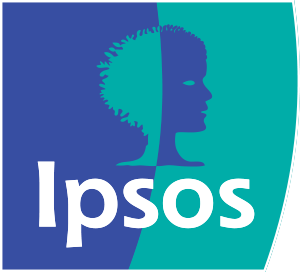

1. It’s opening new revenue streams for the gaming industry

Mobile app games are an increasingly important part of the overall gaming ecosystem: they’re attracting new types of gamers; they’re shifting engagement to mobile devices; and they’re opening new revenue streams for gaming publishers.

According to our GameTrack study, the reach of mobile gaming overtook consoles in 2020 and mobile devices have remained the most used gaming platform since.

And while consoles still account for the biggest share of the total time spent gaming, mobile gaming’s share has risen significantly, from 18% of all time spent gaming in 2012, to 33% in 2023.

Revenue for mobile gaming has also rocketed in this time, increasing ten-fold from £200 million in 2012 to £2 billion in 2023. In fact, mobile gaming now accounts of 42% of revenue for the total gaming industry – and that’s before you take ad revenue into account.

Essentially, if you want to reach, engage and monetise gamers, it’s crucial that mobile gaming is in the mix.

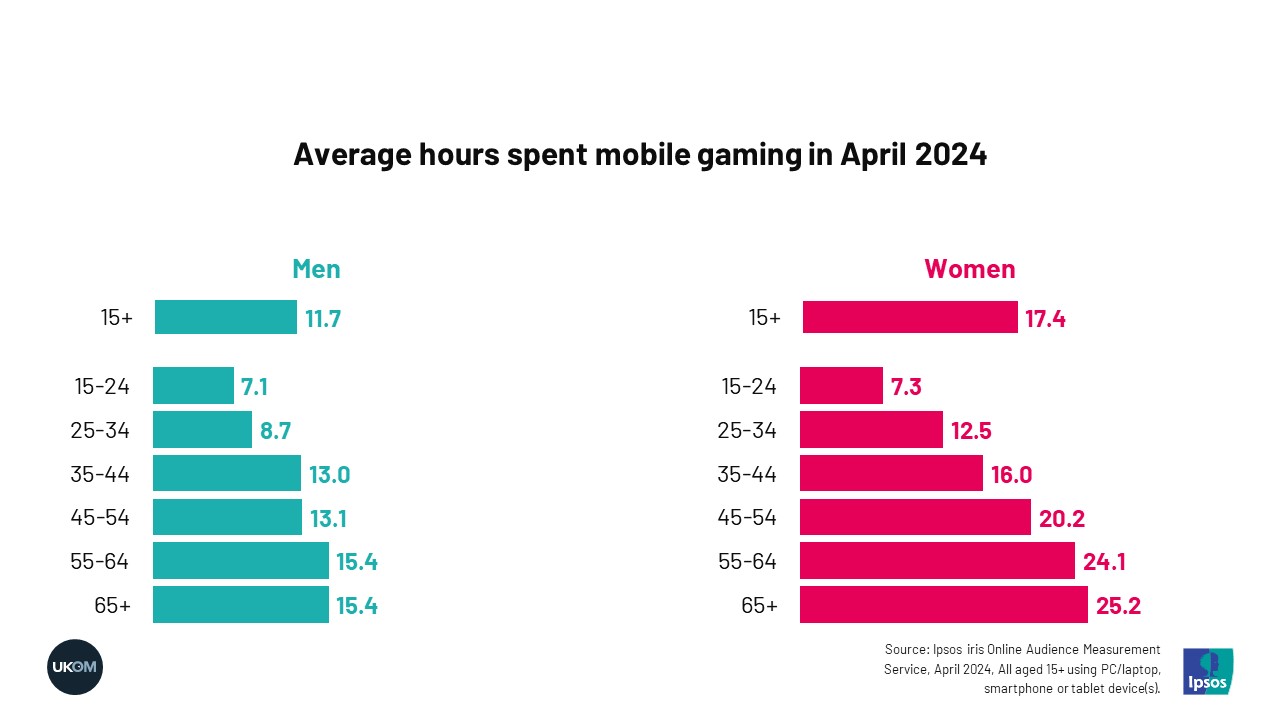

2. It’s unlocking opportunities for growth across audiences

According to Ipsos iris, mobile gaming reached 25 million people in April 2024, which is exciting for two reasons. The first is that this is equivalent to half of all internet users in the UK, reflecting mobile gaming’s ascent to the mainstream; the second is that this is up from 20 million just two years ago.

But what’s really exciting is that reach is high across almost all demographics: both male and female, old and young.

Reach is highest – just about – among men aged 15-24, meaning that mobile gaming is still a great way of reaching young men, just like PC and console gaming.

But unlike consoles and PCs, reach for mobile gaming is essentially just as high among women aged 35-54. So what we’re seeing is a case of evolution not revolution, mobile gaming hasn’t changed the traditional strengths of gaming, but has greatly expanded them.

This broad reach means whether you’re a gaming publisher, an advertiser, a media owner or a brand, mobile gaming can help you grow reach across essentially all age groups, which is no small feat in an increasingly fragmented media landscape.

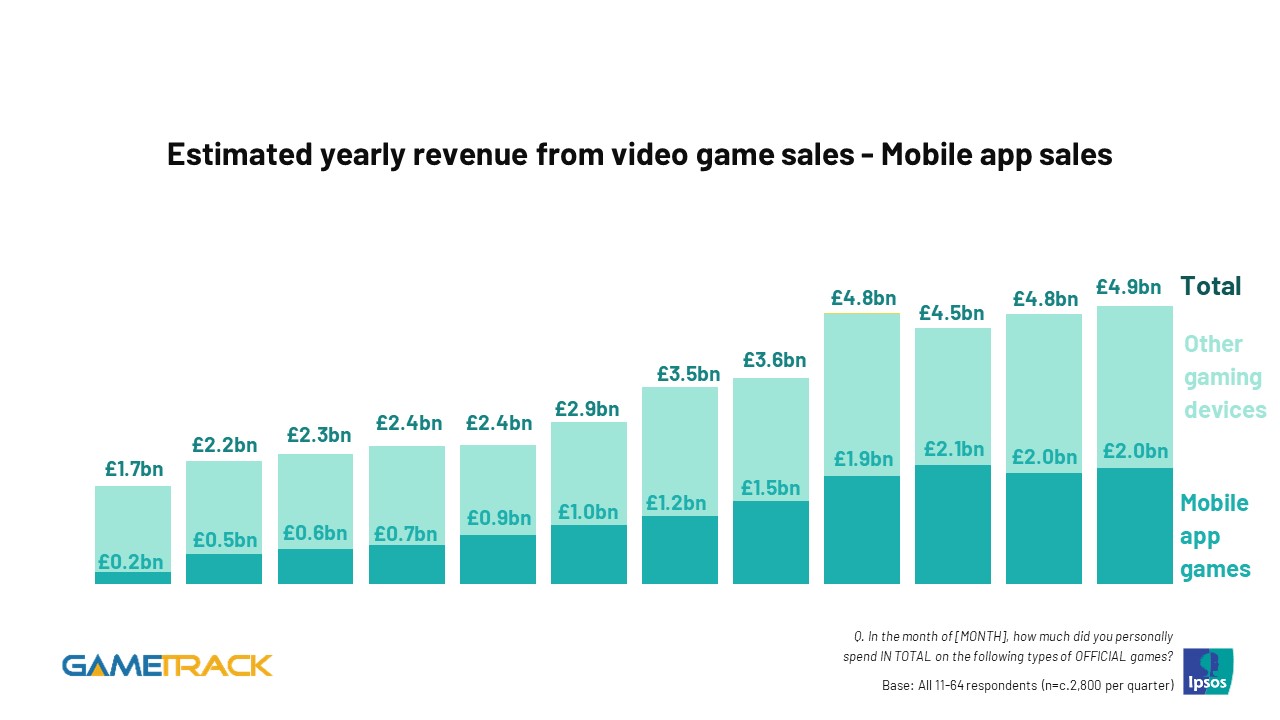

3. It’s a high engagement medium in a high distraction world

Ipsos iris shows that gamers spent almost 15 hours on average playing mobile games in April, which equates to around half an hour a day. That’s a significant amount of time.

But engagement is even higher for older audiences, particularly older women. In fact, female gamers aged 65+ played mobile games for an average of 25 hours in April, the equivalent of 50 minutes a day.

Not only do older audiences deliver engagement, but they also deliver frequency. Over one in five mobile gamers aged 65+ (22%) played a mobile game every day in April, compared to one in ten 15-24 year olds (10%).

For older audiences then, gaming appears to be more habit-forming, as they are playing more regularly, for longer periods of time, compared to younger games whose habits are more akin to ‘snacking’.

These highly engaged, high frequency, and habit-forming older players are a valuable audience for advertisers, in turn making mobile gaming a valuable channel for reaching them.

4. They are a more active audience, which means more opportunities to convert

Mobile gamers are more active across a wide range of online categories, many of which make them a very appealing audience for advertisers.

For example, mobile gamers are much more active on the retail category. They spent 10 hours and 14 minutes on retail sites and apps in April, which is 35% longer than the 7 hours and 35 minutes that non-mobile gamers spent browsing.

Mobile gamers visited more brands, too: they visited an average of 28 retail brands across the course of the month, compared to 23 for non-mobile gamers.

While more time and more brands doesn’t necessarily mean more purchases, it certainly means more opportunities to convert.

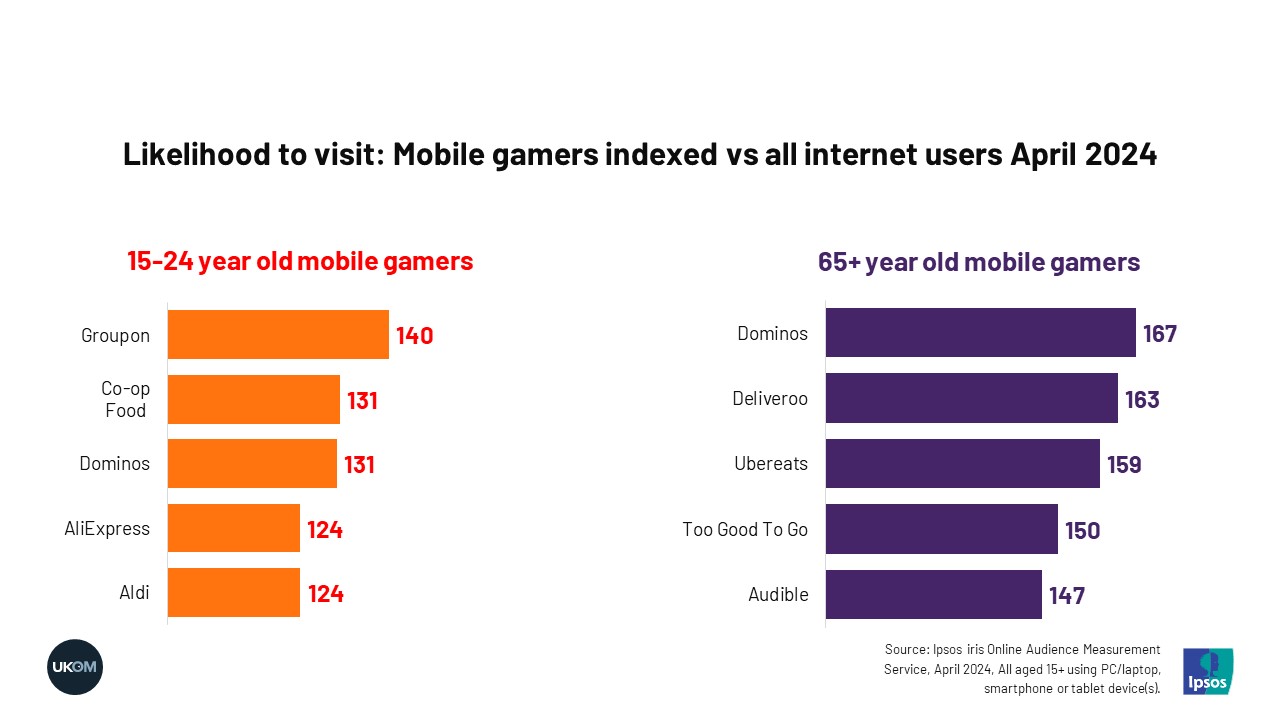

We can also go a level deeper and see that of the top 50 biggest online retailers, 15-24 year old mobile gamers were most likely to visit Groupon (+40%) compared to all internet users their age, followed by Co-Op Food (+31%) and Dominos (+31%).

Meanwhile gamers aged 65 and over were more likely to have visited Dominos (+67%), Deliveroo (+63%) and UberEats (+59%) in April, compared to all internet users in their age bracket.

While food is something of a theme across the two groups, there is a long list of other retailers and categories where mobile gamers show as being more active, which Ipsos iris can help explore and tap into.

5. It’s the perfect channel for targeted planning

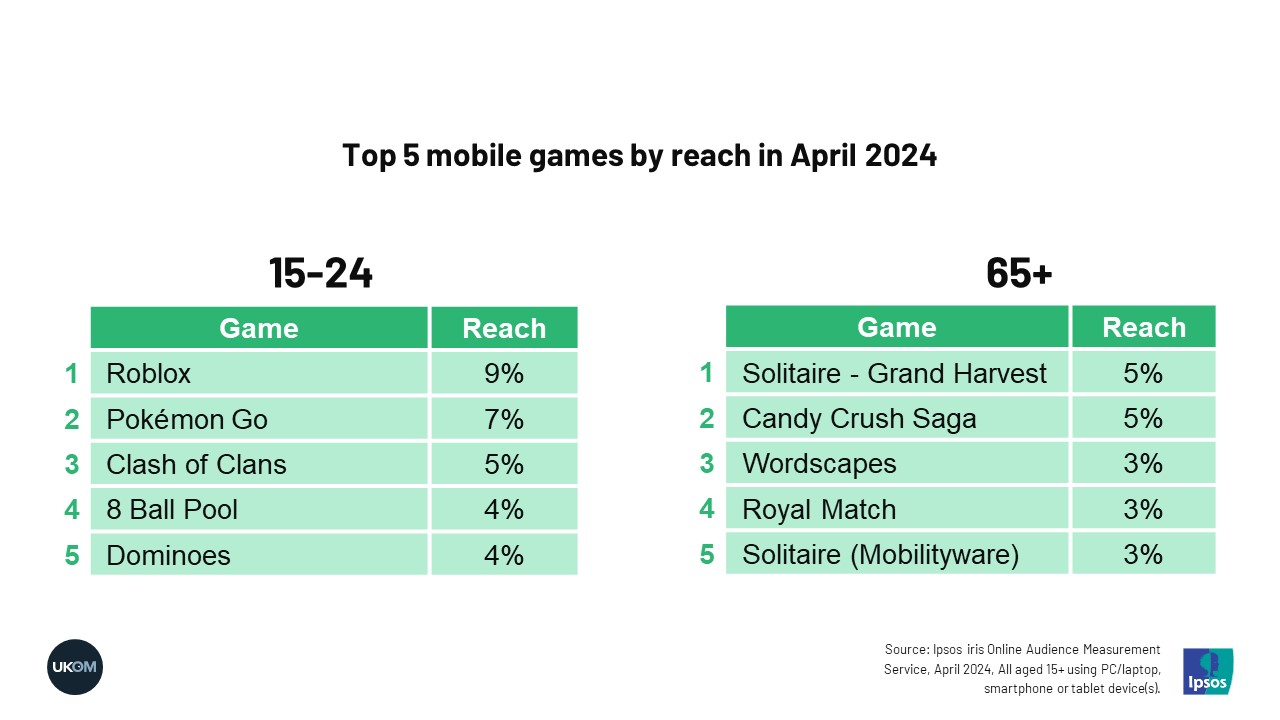

Another great strength of mobile gaming for advertisers is the different audiences that form around different games, which they can use for more precise targeting.

Take, for example, two of the most popular mobile games for 15-24 year old players in April: Pokémon Go and Clash of Clans. While both games would be great for reaching a young audience, they also give advertisers the option to be much more targeted if needed.

For example, 22% of Pokémon Go players aged 15-24 say they identify as lesbian, gay, bisexual or that they identify in another way, which is a much higher proportion than we see for the total internet population in this age group (14%) or for Clash of Clans (6%). So Pokémon Go could provide a great means of reaching an LGB+ audience.

Ipsos iris data also shows how the games can help target audiences with different attitudes. While Pokémon Go players are twice as likely as Clash of Clans players to agree that they were designer clothes (22% agree vs 11%), Clash of Clans players are significantly more likely to agree that it’s worth paying extra for quality goods (81% vs 68%). Again, each audience would bring something different to a media plan.

So just by looking at two games, we can begin to see how each group of players could potentially enable advertisers to be much more specific with their targeting.

If you were to look across the hundreds of mobile games we measure in Ipsos iris you’d find the exact game – or combination of games – that can help you reach the right audience, at the right time, with the right messaging.

Download the full report

Simply click Download to receive the full 40+ page deep dive into Mobile Gaming in pdf format.

Feel free to share this with colleagues and contacts.

Reach out to our team to ensure that you receive future analysis and reports by emailing sales.iris@ipsos.com

*All data from Ipsos iris is for the total internet population aged 15+, playing mobile app games on mobile phones and tablets. More information on our methodology can be found here: https://ukom.uk.net/ipsos-iris-overview.php

All data for points two to five is from Ipsos iris.

**All data from GameTrack is for 2023 based on c.3000 respondents in the UK aged 6-64 each quarter.

All data from point one is from GameTrack.

GameTrack is Ipsos’ flagship gaming study that we have run since 2011 on behalf of Video Game Europe (www.videogameseurope.eu/), the national trade association of video games for the European Union. The study covers consoles, portables, PCs and mobile devices for both physical and digital formats for the UK, Germany, France, Spain and Italy.